Salem Group’s Soft Financial Results May Signal Money Problems for Right Wing Media

By David Lieberman, March 12, 2023

This year is off to a rocky start for radio, digital, and publishing company Salem Media Group – home to Dinesh D’Souza and other right wing stars – and CEO David Santrella said Facebook is partly to blame.

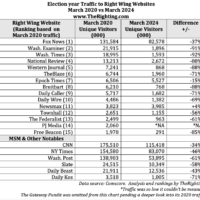

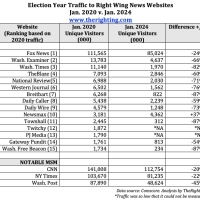

“Facebook implemented changes to its algorithm to feature less political content,” Santrella told investors last Wednesday. “This has led to a significant decline in traffic from Facebook to Salem’s conservative opinion websites.”

Salem shares fell more than 22 percent by the market close on Friday after it warned that revenues in the current quarter could decline from the same period in 2022. Salem also said it lost $2.2 million in the last three months of 2022, down from a $16.8 million profit in the same period in 2021, on revenues of $68.8 million, down 0.5 percent.

Headwinds Galore

Despite its relatively small size, the publicly traded company offers one of the clearest insights into the financial health of right-wing media. Salem calls itself “America’s leading multimedia company specializing in Christian and conservative content.” It owns 101 radio stations, the Salem Radio Network, Salem Web Network, and Regnery Publishing, whose authors include Sen. Ted Cruz, Dennis Prager and Mary Grabar.

The company’s political opinion, religious and investment advice websites were hit hard in the fourth quarter of 2022. Operating income for the Digital Media group plummeted 44.3 percent to $1.7 million on a 10.3 percent drop in revenues to $10.4 million.

In addition to the new Facebook algorithm, Santrella cited a drop in digital ad rates as browsers and mobile devices block access to third-party cookie information.

These changes come on top of what he called “the slowing down of the overall economy” – which the federal Bureau of Economic Analysis says grew 2.7% in the quarter – as well as the loss of help from the government during the pandemic.

“In 2021, we had a lot of spending from the government, promoting vaccines and whatnot,” he said. “Well, that advertising is not really there as much anymore.”

With rising interest rates, Salem also struggles to sell radio ads to real estate and mortgage companies – one of its biggest categories. Operating income for the Broadcast group fell 17.4 percent to $10.1 million on revenues of $53.3 million, up 4.5 percent.

High Hopes for Books

Salem recently picked up radio stations in Miami, a hot market in election years. But that will probably be it for the company’s Florida acquisitions: “We feel good with the three licenses that we have that we can achieve what we’re trying to accomplish there,” CFO Evan Masyr said.

The Publishing group had a light release schedule at the end of 2022, resulting in a loss of $0.6 million, down from a $0.2 million profit in 2021, on revenues of $5.2 million, down 21.3 percent.

Even so, the company said the numbers were better than expected from sales of Cruz’s Justice Corrupted and Eric Metaxas’ Letters to the American Church.

Salem COO David A. R. Evans said he expects publishing revenues to grow this year with books including Sen. Josh Hawley’s Manhood: The Masculine Virtues America Needs; George Gilder’s Life After Capitalism; and Gad Saad’s The Saad Truth About Happiness. He also mentioned a release from Tulsi Gabbard, who recently signed a deal with Regnery to publish her memoirs.

David Lieberman covered the media business full time for 30 years at USA Today and other publications before joining The New School as an Associate Professor in its graduate Media Management program.

Interested in more news about right-wing media curated especially for mainstream audiences? Subscribe to our free daily newsletter.